Frs pension calculator

While you are in the DROP. FERS is a type of retirement plan that is made up of Social Security pension and the retirees savings.

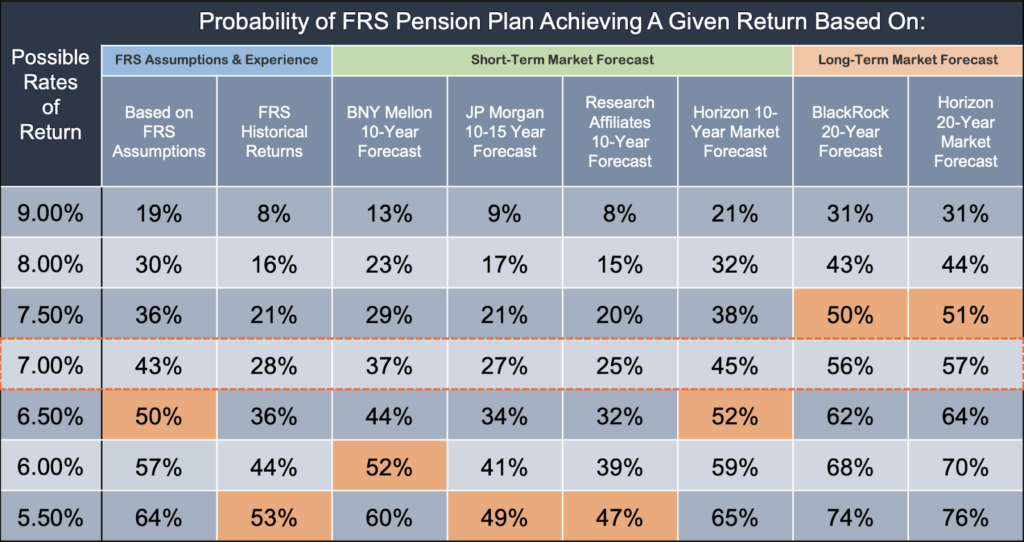

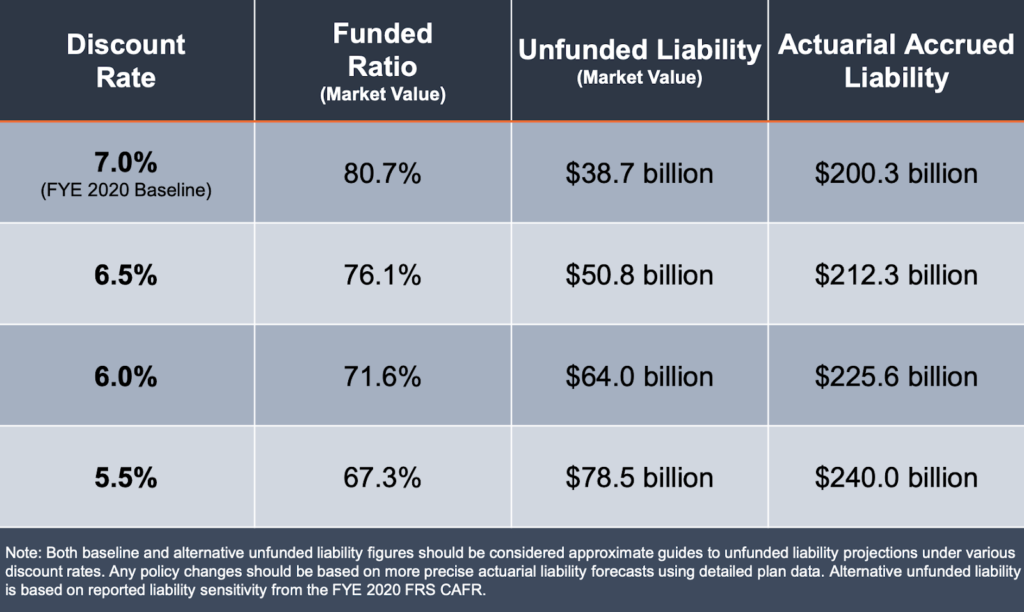

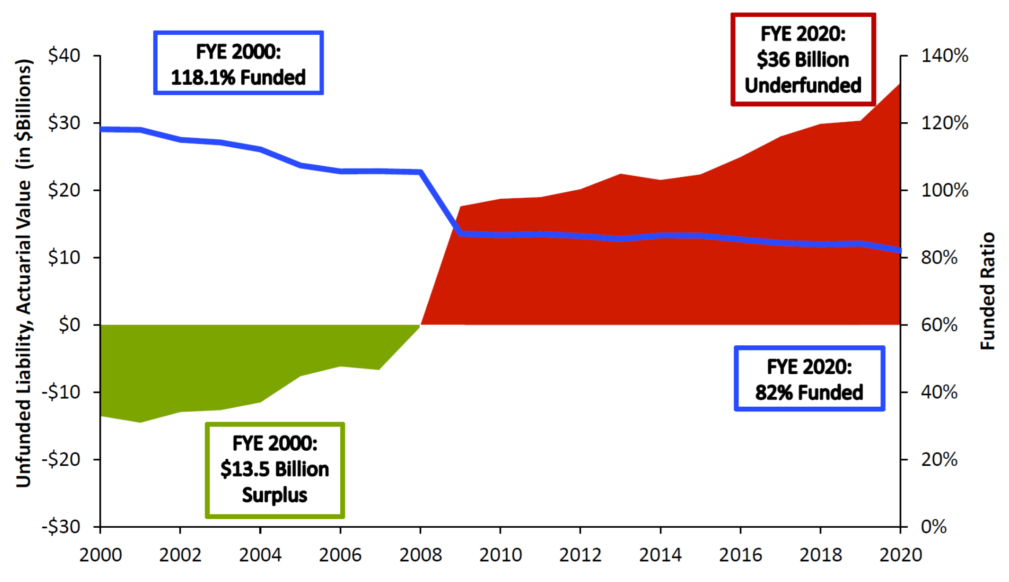

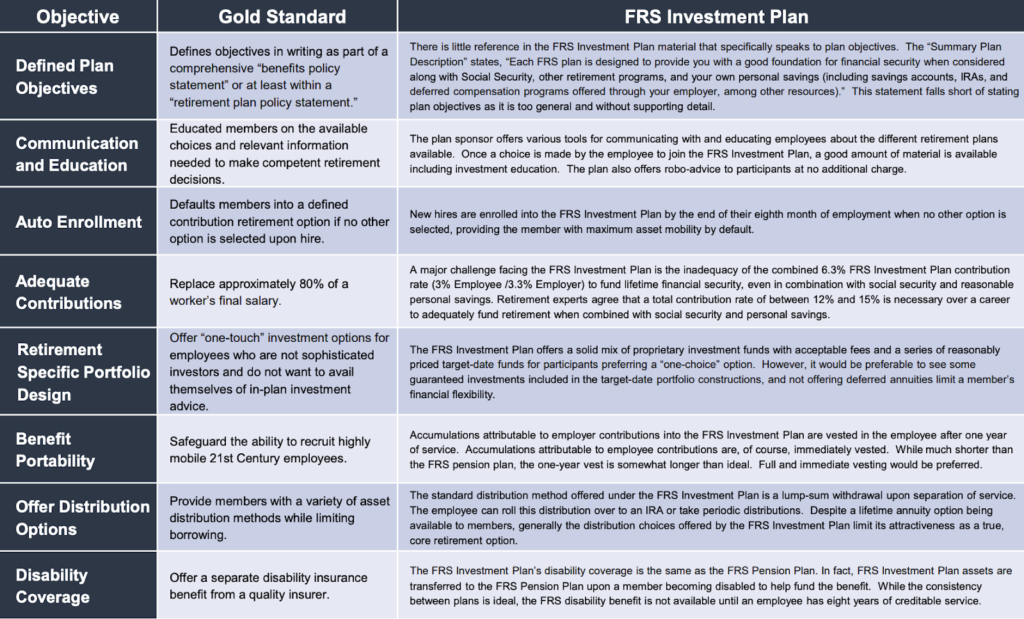

Florida Retirement System Frs Solvency Analysis

Ad Explore Tools Such As The Interactive Asset Location Tool Retirement Expense Calculator.

. State Board of Administration of Florida 1801 Hermitage Blvd Suite 100 Tallahassee. Ad Create a more efficient retirement and guarantee income with a DPL solution. Ad Its Time For A New Conversation About Your Retirement Priorities.

Ad Business advisors CFOs across all company sizes industries rely on Fathomtry it free. Your annual savings expected rate of return and. Under Age 62 at Separation for Retirement OR.

For regular risk teachers admin etc. Get Financial Analysis Management Reporting Cash Flow Forecasting Consolidations. 75 of your average highest 5 paid years.

Ad Calculate Your Personal Pension And See How Much Income You Could Receive In Retirement. Use this calculator to determine your Required Minimum Distributions RMD as an. Ad Explore our advanced education opportunities all you need as a financial professional.

This website also has resources such as publications and estimate calculators to help you understand your. FERS Basic Annuity Formula. The Federal Employees Retirement System FERS was established by Public Law 99-335 in Chapter 84 of title 5 US.

View your retirement savings balance and your withdrawals for each year until the end of your retirement. 48 of your average 8. Computation for Non-Disability Retirements.

FRS Pension Plan Normal Retirement FRS Investment Plan. In the US the most popular defined-contribution DC plans are the 401 k IRA and Roth IRA. Deferred Retirement Option Program.

The amount of your future benefit is determined by a. FRS Pension Plan Information. For most FERS their pension multiplier is 1.

The pension is composed of the FERS basic benefit and the FERS supplement for. Going through the FERS Retirement Calculator steps above she would answer Yes to 1 No to 2 and Yes to 3. FRS Online Services benefit calculator service history etc Division of Retirement DOR Calculations.

Welcome to FRS Online. Use this calculator to determine how much monthly income your retirement savings may provide you in your retirement. Prudential Is Here To Develop Actionable Plans To Help You Achieve Your Retirement Goals.

Age 62 or Older With Less Than 20 Years of Service. Its Never Too Early To Start Saving For Retirement. Your multiplier will be 1 unless you retire at age 62 or older with at least 20 years of service at which point your multiplier would be 11 a 10.

Ad Whatever Your Investing Goals Are We Have the Tools to Get You Started. Ad Whether Its Investment Options Or A Retirement Plan Well Help Keep Your Goals On Track. Ad Its Time For A New Conversation About Your Retirement Priorities.

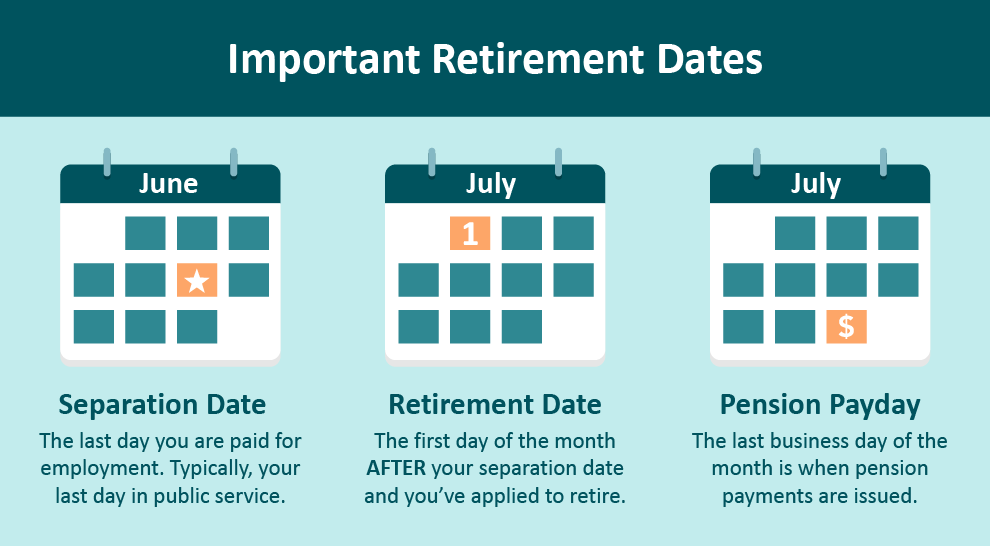

You may participate in the Deferred Retirement Option Program DROP once you have reached normal retirement age or date. Discover the Benefits of a Commission-Free Annuities in the Financial Plan. The FRS Pension Plan is a defined benefit plan in which you are guaranteed a benefit at retirement if you meet certain criteria.

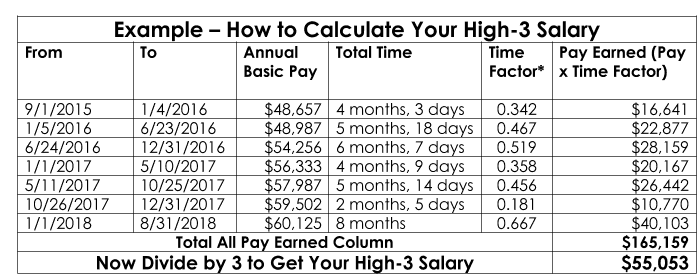

Jacksons Assessment Tools Can Help Kickstart A More Meaningful Conversation With Clients. So your FERS retirement pension is determined by three factors your High-3 Salary your Years of Creditable Service and your Pension Multiplier. Code and effective January 1 1987.

Use this calculator to help decide between joint survivorship and single survivorship pension options. Get Started With TIAA Today. If you are a member of the Florida Retirement System FRS Pension Plan you can access your personal retirement account information including service history service.

Use this calculator to help decide which pension option works best for your particular retirement needs. 65 50 15. Your first year benefit is based on a fixed formula and is determined by your age years of service the average of your highest 5 or 8.

Use this calculator to help you create your retirement plan. Visit the FRS Pension Plan website to view details on the FRS Pension Plan. Under this program you stop earning service credit toward a future benefit and your retirement benefit is calculated at the time your DROP participation begins.

A good calculation when deciding whether to receive the pension or the Lump-Sum is comparing them to each other using the following formula. Years of Service. DC plans are now the most popular pension plans in the US especially in the private sector.

Our Expert Investment Professionals Focus To Maximize Returns And Strive To Manage Risk. Delivering premier investment consulting wealth management credentials. For most high risk employees police officer firefighters etc the pension will be.

Most new Federal employees. Divide your annual pension amount by the. Your multiplier is the easy part of the equation.

Florida Teacherpensions Org

Tax Withholding For Pensions And Social Security Sensible Money

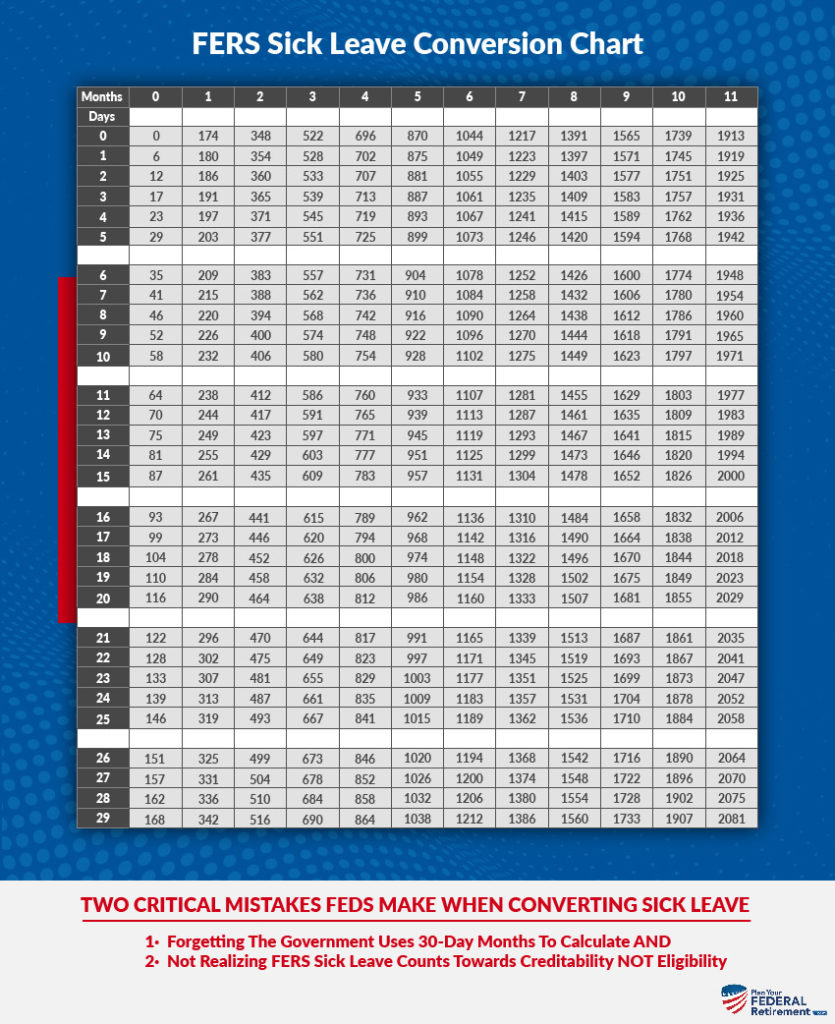

Fers Retirement And Sick Leave Plan Your Federal Retirement

2

Xwtf2rthoh0ihm

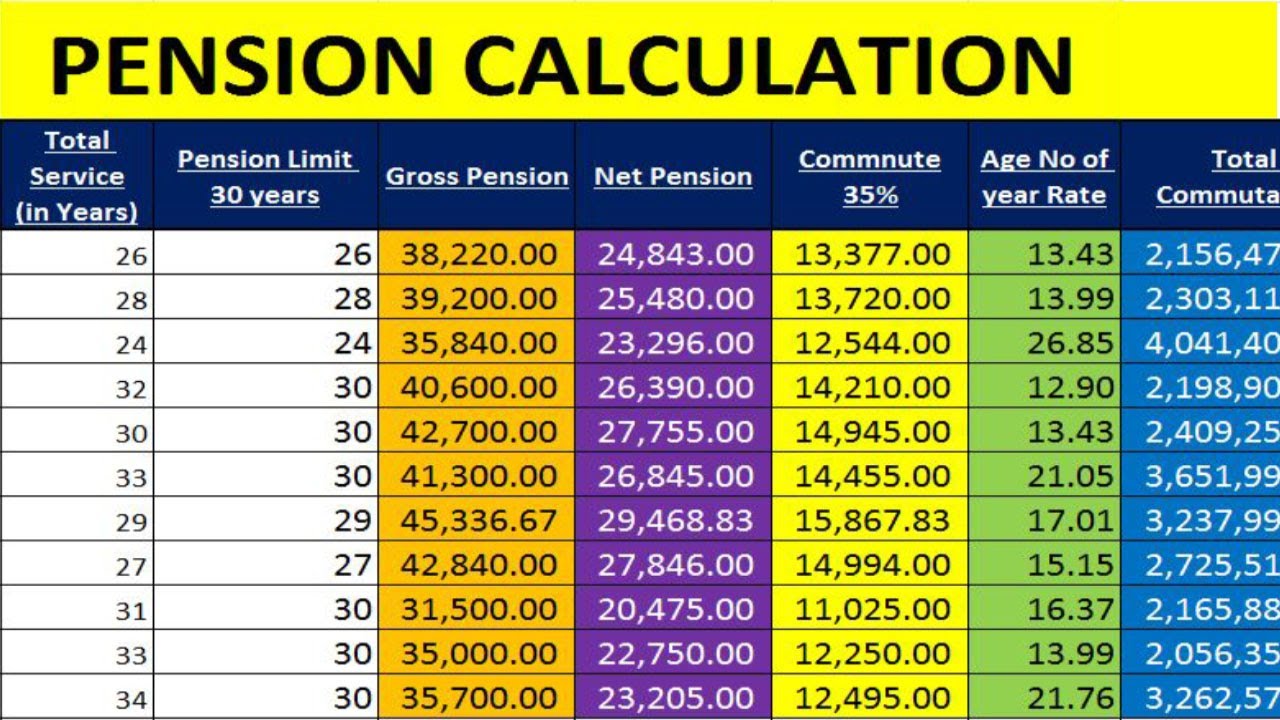

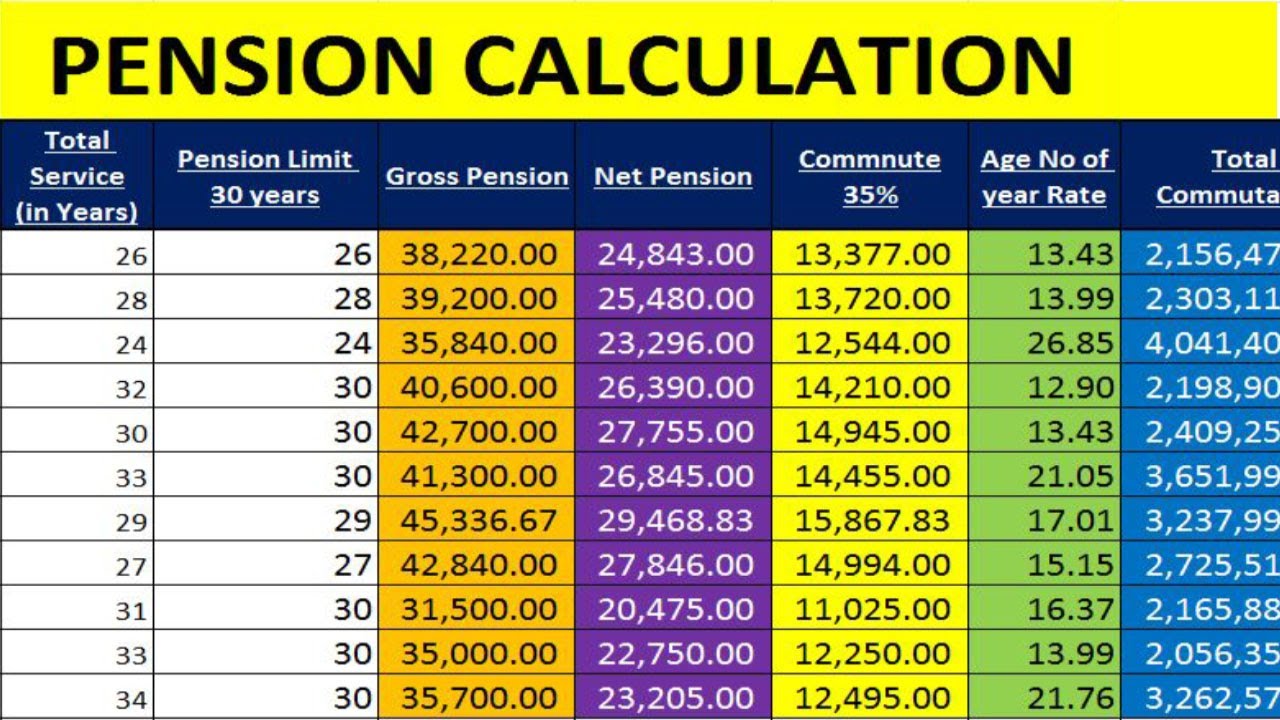

Pension Calculation In Excel Of Govt Employees By Learning Center In Urd Learning Centers Excel Tutorials Excel

Calculating Service Credit For Sick Leave At Retirement

Login Frs Online

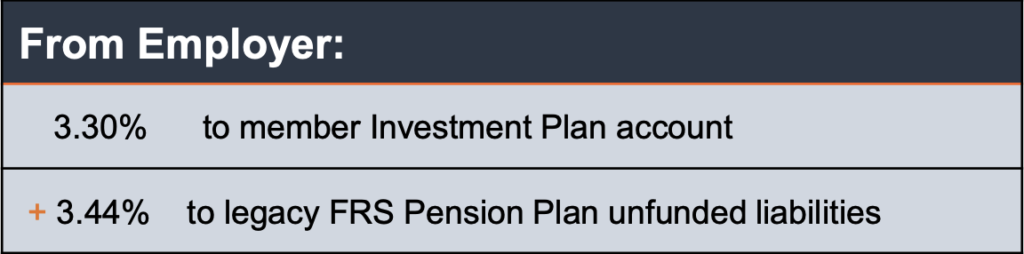

Florida Retirement System Frs Solvency Analysis

Florida Retirement System Frs Solvency Analysis

How To Calculate Your High 3 Salary Plan Your Federal Retirement

Florida Retirement System Frs Solvency Analysis

Florida Retirement System Pension Info Taxes Financial Health

Florida Retirement System Frs Solvency Analysis

2

Fers Retirement Calculator 6 Simple Steps To Estimate Your Federal Pension Retirement Calculator Federal Retirement Retirement

2